wake county nc sales tax rate 2019

Some counties may add additional fees. Wake County Nc Sales Tax Calculator.

Taxes Wake County Economic Development

Box 2331 Raleigh NC 27602.

. North carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275. The current total local sales tax rate in Wake County. The wake forest sales tax rate is.

Physical Location 301 S. Average Sales Tax With Local. Tax rates are applied against each 100 in value to calculate taxes due.

The 2018 United States Supreme Court. 6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina. The North Carolina state sales tax rate is currently.

North carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275. There is no applicable city tax. Some counties may add additional fees.

Prepared Food and Beverages This tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises by any retailer with sales in Wake County that. Wake county nc sales tax rate 2019 Mora Woody. A single-family home with a value of 200000.

Wake county nc sales tax rate 2019 Mora Woody. The 725 sales tax rate in Raleigh consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax. 22 rows The total sales tax rate in any given location can be broken down into state county city.

PDF 1927 KB - April 03 2019. The wake forest sales tax rate is. Wake County Nc Sales Tax Calculator.

This is the total of state and county sales tax rates. The Wake County sales tax rate is. Wake County NC Sales Tax Rate.

An alternative sales tax rate of 75 applies in the tax region Durham Co Tr which appertains to. North carolina has a 475 sales tax and wake. You can print a 725.

North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275. Sales and Use Tax Rates. North carolina has a 475 sales tax and wake.

Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not. 35 rows County Rate County Rate County Rate. The property is located in the City of Raleigh but not a.

The Wake Forest North Carolina sales tax rate of 725 applies in the zip code 27588.

Property Tax Calculator Smartasset

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Raising State Income Tax Rates At The Top A Sensible Way To Fund Key Investments Center On Budget And Policy Priorities

Median Sales Price Of Wake County Real Estate Hits Another New All Time High Of 405 000 In November 2021 Wake County Government

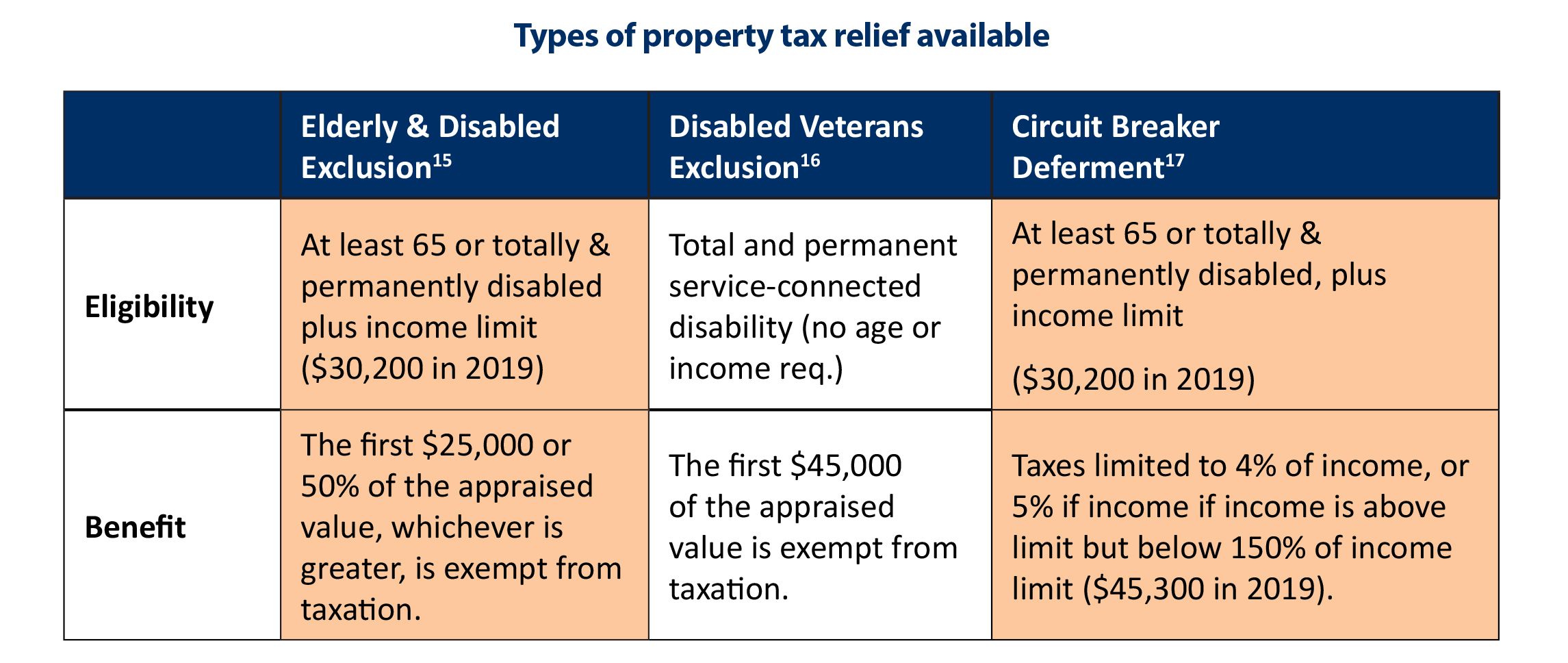

The Ultimate Guide To North Carolina Property Taxes

Experience Downtown Wake Forest Town Of Wake Forest Nc

The Research Triangle Region Is Regularly Cited As One Of The Best Places To Do Business In The Nation Nc Has A Corporate Income Tax Rate Of 3 The Lowest In The Southeast A Variety Of Incentives Are Available At The Local And State Levels For Companies

Wake Forest Business Industry Partnership

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

Sales And Use Tax Rates Effective October 1 2020 Ncdor

Sales Taxes In The United States Wikipedia

Organizational Chart Town Of Wake Forest Nc

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

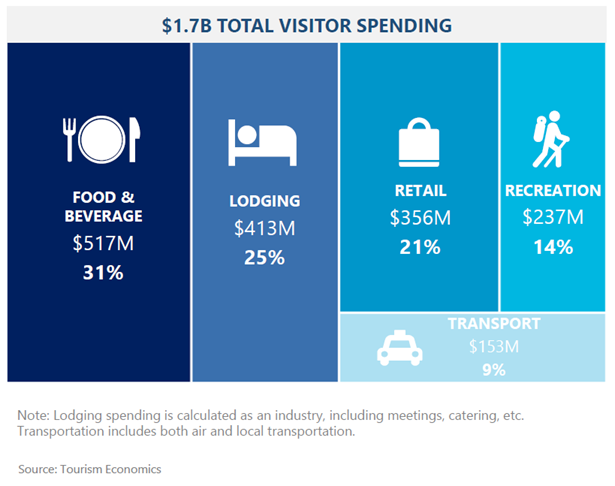

2020 Wake County Visitation Figures Released

Budget Apex Nc Official Website

Median Sales Price Of Wake County Real Estate Hits Another New All Time High Of 405 000 In November 2021 Wake County Government

Wake County North Carolina Wikipedia

State Taxes On Capital Gains Center On Budget And Policy Priorities

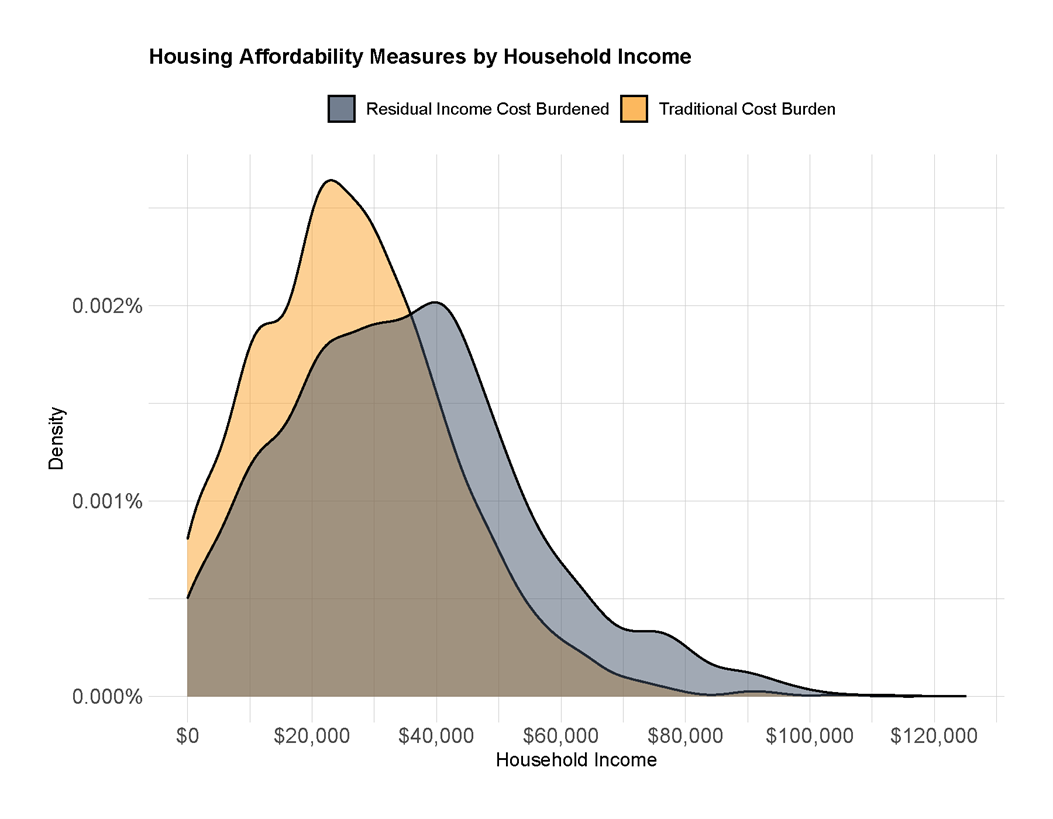

How Should We Measure North Carolina S Affordable Housing Crisis Community And Economic Development Blog By Unc School Of Government